Imagine two potential client experiences.

In the first, clients call you whenever they have questions about their portfolio’s performance, balance, or just for a reminder of what their financial plan looks like.

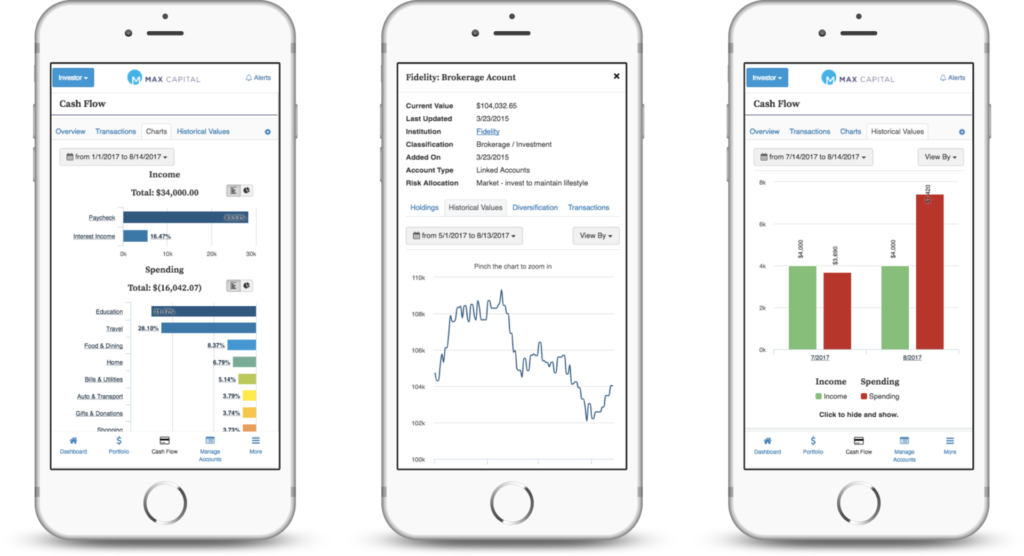

In the second, your clients have a mobile app that allows them to check their portfolio on their own whenever they want.

Which experience sounds better to you as an advisor? Better still, which experience do you think would sound better to clients? The second option sounds better on both ends – for you because it means fewer interruptions, and for your clients because it means freedom and empowerment.

In this article, we will look at how mobile apps are quickly moving from a nice-to-have feature to a must-have feature for advisors who want to remain competitive, as well as how to go about creating a mobile app for your firm.

Smartphone & App Trends

There are more than two billion smartphone users around the world and that figure is expected to grow to nearly three billion by 2020. In the U.S. alone, the number of smartphone users surpassed 220 million in 2017 – that’s more than two-thirds of Americans. These trends show no sign of slowing as smartphones move beyond communication and into gaming, payments, music, and even finance.

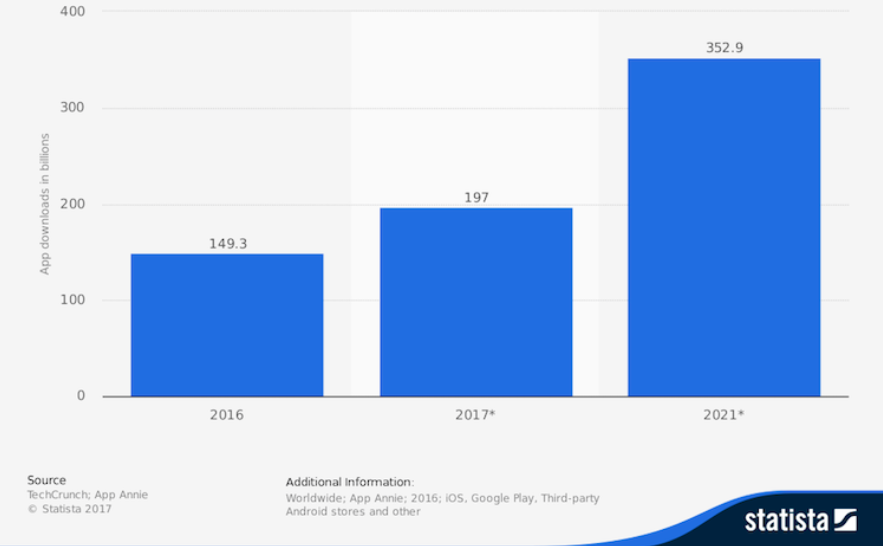

As recently as 2010, only five percent of websites were browsed via mobile phone, but by 2016, mobile surpassed desktop with 51 percent of site traffic, and that figure has only grown since then. With that increase has come a rise in mobile apps, with nearly 200 billion app downloads last year.

So what does this have to do with the financial world? According to Bankrate, 63 percent of smartphone-using adults in the US have at least one financial app. The number of financial apps ranges from an average of 1.4 apps for Gen-Xers to an average of 3.6 apps for millennials. While mobile banking apps are the most popular, investing apps appear on about 17 percent of US smartphones.

Why You Need a Mobile App

The wealth management industry isn’t exactly known for embracing technology, and that has come at a cost when attracting clients – especially younger ones. Robo-advisors offer on-demand portfolio management and planning services, and millennials are nearly eight times more likely than baby boomers to use these services instead of a traditional advisor.

Half of millennials surveyed indicated that they are required to schedule in-person meetings with their advisor to make changes to their investments, despite 44 percent reporting that they would like the ability to make changes on a mobile app. These clients also expressed an interest in receiving personalized emails or text messages related to their financial goals or market changes, as well as data-driven predictions on portfolio performance.

In addition to robo-advisors, tech-savvy advisors are also benefiting from these trends. According to Fidelity, eAdvisors have 42 percent more AUM, 35 percent more AUM per client, and 24 percent higher compensation than their non-tech savvy peers. Juniper Research projects that AUM on digital platforms will surpass $4 trillion by 2022, enabling larger firms to reduce costs and increase profitability.

Mobile apps can help advisors in many different ways, including:

- Enhanced Prospecting – Advisors can offer mobile apps to prospects as a way to preview their services, while collecting data across the client’s accounts to create a compelling and customized proposal.

- Better Client Experience – Many clients want to have 24/7 access to their assets as it helps them feel in control of their financial lives. The combination of a client portal and mobile app enables them to access this information online or via their smartphone.

- Frequent Communication – Data aggregation makes it possible to keep a closer eye on a client’s complete accounts, while mobile apps make communication a lot easier than scheduling in-person meetings.

Build vs. Buy Decisions

When you look at getting your own mobile app, you have two options: build a custom app from scratch or partner with a white-label app provider such as Wealth Access.

Each comes with its own set of pros and cons. For instance, if you build a custom app, you can make it do anything you want, but the downside is that custom app development can easily cost over $1 million, and then all the customer service and troubleshooting is on you and your team. If you go the white-label route, you may not feel like the app is truly “yours,” but you’ll get it at a fraction of the price, and you’ll get a designated IT team to take care of any potential issues that arise.

The other great thing about white-label app providers is that most of them put your name and logo on the app, so to your clients, it truly is your app.

At Wealth Access, we handle every aspect of development and then deploy the app on the Apple and Google app stores for you.

The Bottom Line

There’s no doubt that smartphones and mobile apps will continue to grow in popularity. With nearly 20 percent of smartphone users using investing apps, it’s time for advisors to embrace mobile technology to improve client experience, enhance prospecting activities, and communicate more frequently.

For more information about Wealth Access, check out our Advisor Solutions or contact us for a free consultation.