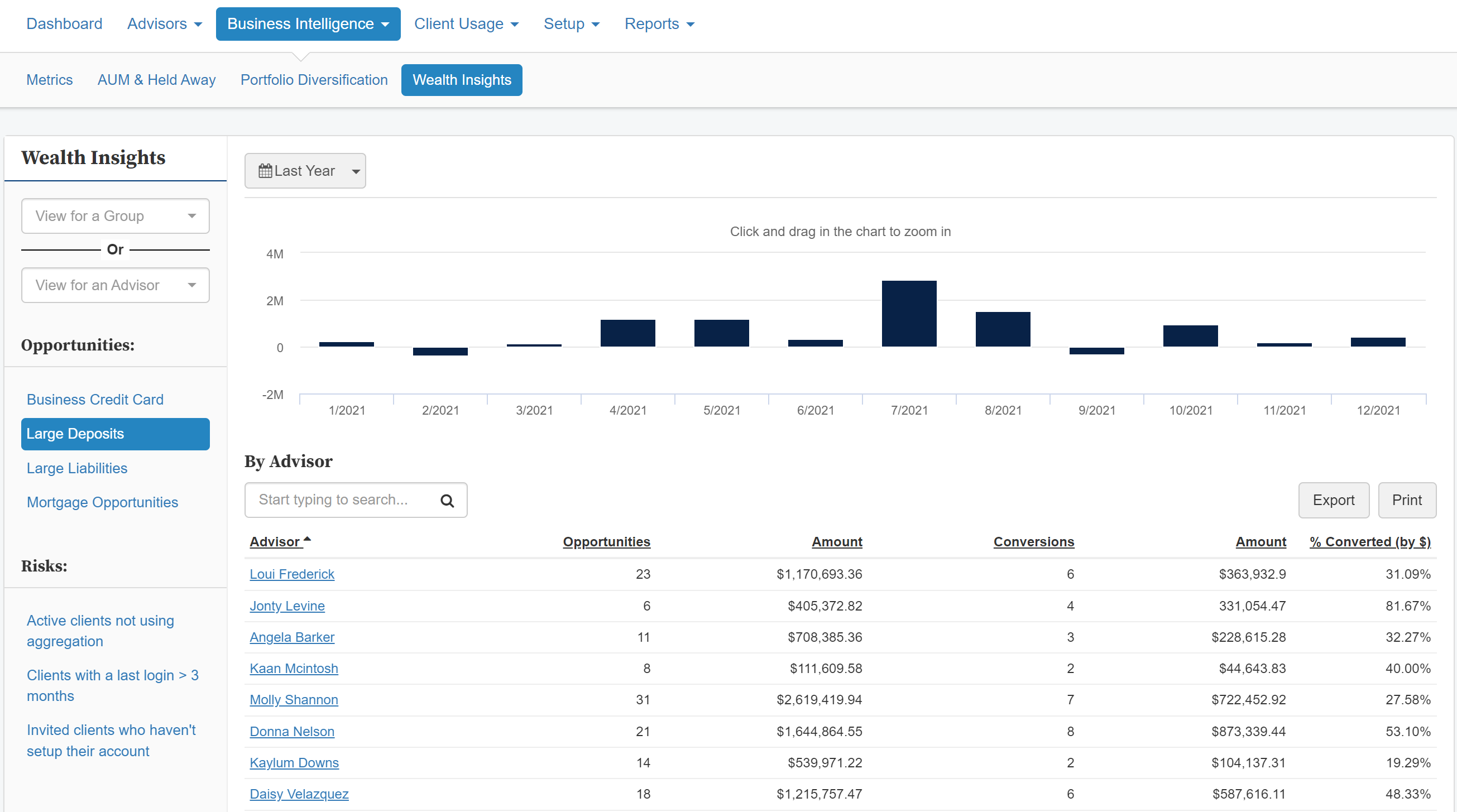

In Wealth Access, advisors can use Wealth Insights to proactively identify opportunities to expand their relationship and increase engagement with clients, which can help banks gather more deposits. Firm administrators can view the same data broken down by each advisor to provide support where needed and can even configure custom opportunities.

Let’s look at how that plays out in the app:

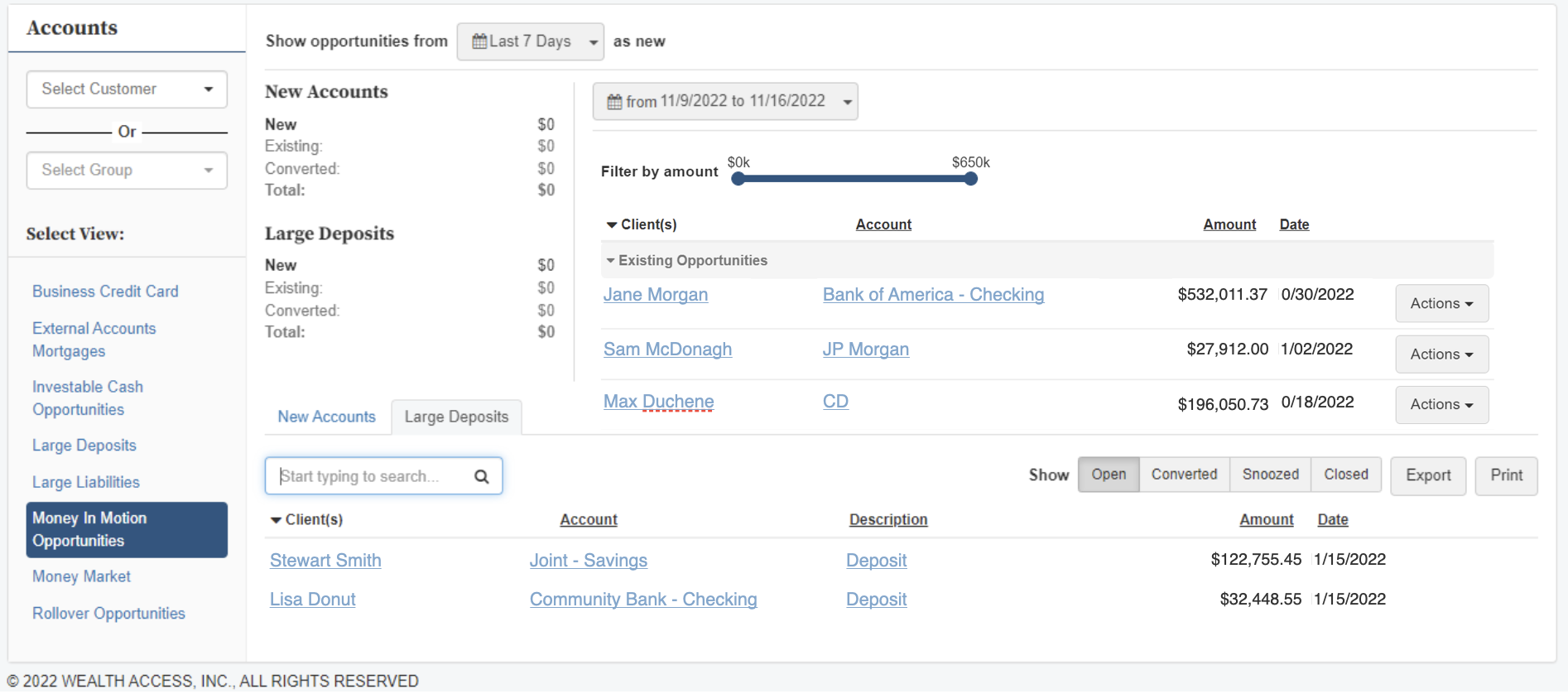

Money in Motion identifies large deposits to pinpoint significant changes across an advisor’s book of business.

Large Deposits identifies deposits over a specific threshold across an advisor’s book of business.

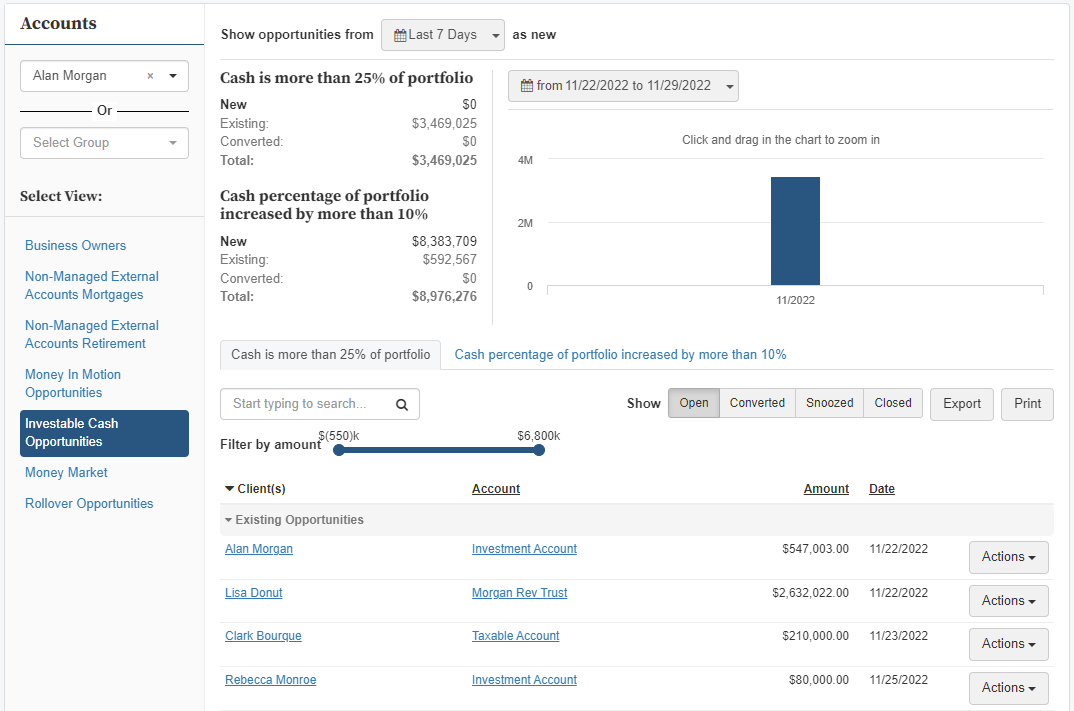

Investable Cash Opportunities tracks cash assets as a percentage of a client’s portfolio and identifies large percentage increases.

Your Bank + Wealth Access = Good Things

Let’s talk about the future of your financial institution and how you can increase client engagement. Click here to schedule a demo now.