When you choose advisor technology for your firm today, selecting an integrated solution is on nearly everyone’s list of “must-have” features.

In our interconnected world in the wealth management industry, it would almost seem crazy to add a new tool to your technology stack that doesn’t have some capability to interface with and share data between the existing solutions you already use to run your advisory firm.

But too often, technology solutions that tout “integration” are not creating real solutions that increase operational efficiency and streamlined workflows for the average advisor. Instead, they create a minimum viable solution.

While a single-sign on button may be helpful in logging into one system from another, that level of integration does not aid you in creating a more unified client experience.

At Wealth Access, we believe in creating deeper and more robust integrations with our technology partners so our advisors can achieve tangible, day-to-day benefits from the technology they choose to build their business around.

During this year’s Orion Advisor Services Ascent user conference and FUSE fintech competition, we announced several updates to our integration with Orion that we believe will help you drive higher client adoption with more integrated personal financial management tools.

Let’s look at the details.

How Integration Updates Benefit Your Firm and Clients

When looking to drive higher client adoption of your technology tools, you need to start with a client-centric mentality and identify what makes the most sense for your client.

Creating a tech solution that provides compelling, engaging, and useful information to them—with simple and intuitive navigation—will help you create a wealth management experience that keeps clients coming back and puts you front-and-center.

The bottom line is that as client adoption grows, the ROI for your advisors will grow as well.

The enhancements to our integration with Orion will benefit your firm in three key ways:

Gain Additional Insights into Client Behavior

As a Wealth Access user, you already can achieve cost-effective and scalable aggregation for held-away client assets. With our updated integration, these assets now sync to Orion’s client portal so you can gain additional insight into your client’s total net worth and ultimately, grow your business.

Increase Your Ability to Retain Clients

The Orion Client Portal offers advisors a robust, multi-faceted tool for communicating with clients. Our integration puts the Wealth Access Personal Financial Management tools directly in your current portal so your clients can access them seamlessly as a part of their complete digital financial experience. Offering PFM tools helps you further engage with clients, which can lead to higher client retention and overall stronger relationships.

Enhance the Client Experience

It all comes back to the client, right? The enhanced integration with Orion keeps all your client’s data synced between both systems so you can provide a central location for a complete wealth picture from anywhere, at any time, using your client portal and mobile app.

So what are the features contained in our enhanced integration? We’ll cover the technical details in the next section.

The Enhanced Wealth Access and Orion Integration

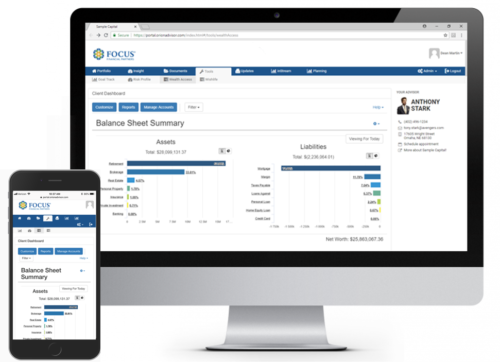

Our updated integration combines the power of Wealth Access’ award winning PFM and intelligent aggregation with Orion’s integrated portfolio accounting for the most comprehensive, fully-mobile client experience.

The integration now offers all of these features to advisors utilizing both solutions:

- Single Sign-On between both systems

- Orion accounts pushed to Wealth Access

- Wealth Access Balance Sheet in the Orion Client Portal app

- Wealth Access Widgets in the Orion Insight app for client presentations

- Orion Insight app tiles added to Wealth Access

- Wealth Access aggregated held-away data pushed to Orion

This integration creates as close to a seamless, one application experience between both systems as possible. When using the Orion Client Portal or mobile app, you’ll have full access to all the most popular Wealth Access features, and all your clients’ aggregated assets.

On top of that, the experience gives you insight into client accounts stored in Orion, through the Wealth Access platform, giving you full access into your client’s data, regardless of which system you’re logged into at the time.

This two-way flow of data creates a comprehensive portal experience where Orion collects and reconciles custodial data from institutions like TD Ameritrade, Schwab, Fidelity, Pershing, and others, and pushes that information to Wealth Access.

In turn, the account data Wealth Access aggregates—from sources like banks, 401(k)s, hedge funds, 529 plans, credit cards, and more—also pushes to Orion.

And because the data that Wealth Access aggregates is synced into Orion, you can then take even greater advantage of that data with the other systems you have integrated with your Orion database, allowing you to take actions like creating more advanced financial plans for your clients.

Taken together, the capabilities for both platforms become more robust as a result of the depth of the integration.

How to Enable the Orion Integration For Your Firm

When you partner with innovative, cloud-based tech solutions that provide constant improvements, one of those improvements you get to enjoy is that you don’t have to worry about making manual updates to get the latest features.

If you’re an Orion or a Wealth Access user, these integration enhancements are available right now in each respective platform. Simply log in to access your integration settings.

If you’re a Wealth Access advisor that needs help with setup, our Support Team is ready to assist.

Don’t work with Wealth Access? Click here to contact our team to schedule a personalized demo for your firm.