One of the most difficult parts of prospecting is getting all of the information you need from a client in a simple, digital format. At the same time, the rise of robo-advisors has made data aggregation the new standard when it comes to offering clients mobile apps. Wealth Access lets traditional advisors improve their prospecting and increase client engagement and satisfaction by easily creating a branded mobile app.

In this post, we will look at how you can use your Wealth Access mobile app to add more value for your prospective clients.

Why Offer a Mobile App?

It’s hard to argue with the numbers on mobile usage.

About 70 percent of the U.S. population uses a smartphone on a regular basis, but that figure rises to more than 95 percent for households earning more than $100,000 per year. More than half of all smartphone users with bank accounts have used mobile banking services over the past year, and about one-third have used mobile payment systems. If that doesn’t convince you, consider that the average person spends about five hours per day on their mobile device.

When it comes to financial advisors, data aggregation has become the new standard over the past few years. Intuit’s Mint.com quickly became one of the most popular personal finance apps by enabling customers to access all of their accounts in one place.

Soon after, robo-advisors began implementing data aggregation to help consumers see their entire net worth in one place, and large traditional advisors have followed closely in their footsteps.

Mobile apps with data aggregation serve two purposes for financial advisors:

- A Better Client Experience – Mobile apps with data aggregation help clients get a vastly more complete look at their financial situation since they can see their entire net worth and how it has changed over time – all in one app rather than twenty.

- Improved Prospecting for Advisors – Financial advisors who use mobile apps with data aggregation can gain unprecedented insights into a potential client’s finances, develop highly-customized proposals, and offer more relevant talking points in meetings.

As you may have guessed by now, we believe in the power of mobile technology. That’s why we make it easy for you to give your clients a mobile app and portal that are custom-branded to your firm.

With direct feeds from more than 20,000 financial institutions, our data aggregation goes beyond many competitors to include hard-to-report-on assets like private investments. These data points are displayed in rich visualizations that include over fifty plug-and-play components and are accessible via an open architecture.

How to Setup Your App for Prospecting

Signing prospects up is as simple as putting in their name and email address, after which they can easily add their financial accounts directly from your web or mobile app. By giving people a reason to input their data (spending/saving analytics), you remove the hurdle of convincing them to hand over financial information.

After that, you can easily access this data on the advisor side, where you can use it during meetings or phone calls, or when you’re creating a proposal or financial plan.

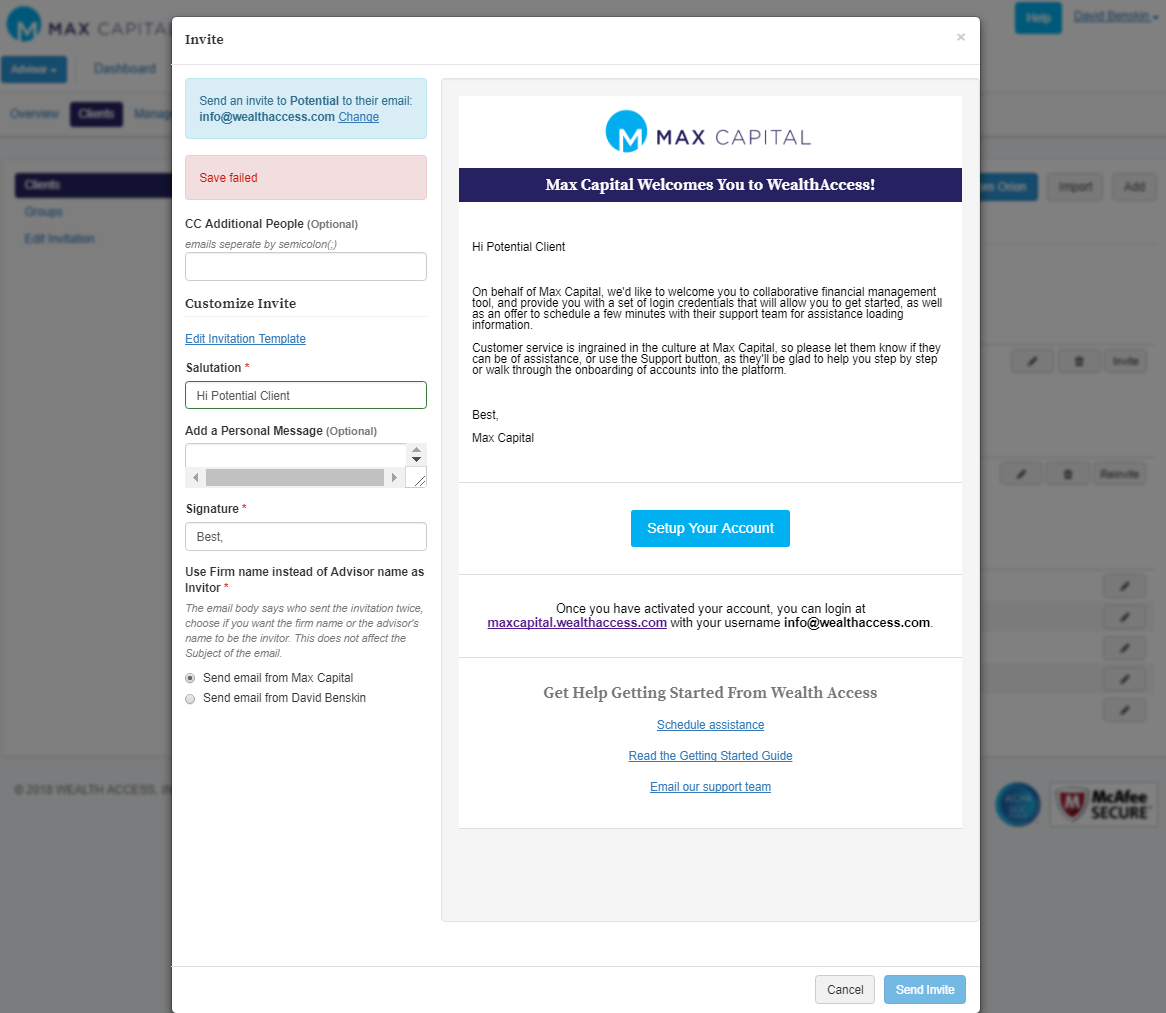

The process starts by simply inputting the prospect’s data to send a welcome email in the advisor web app. You can send a form message or customize it however you like.

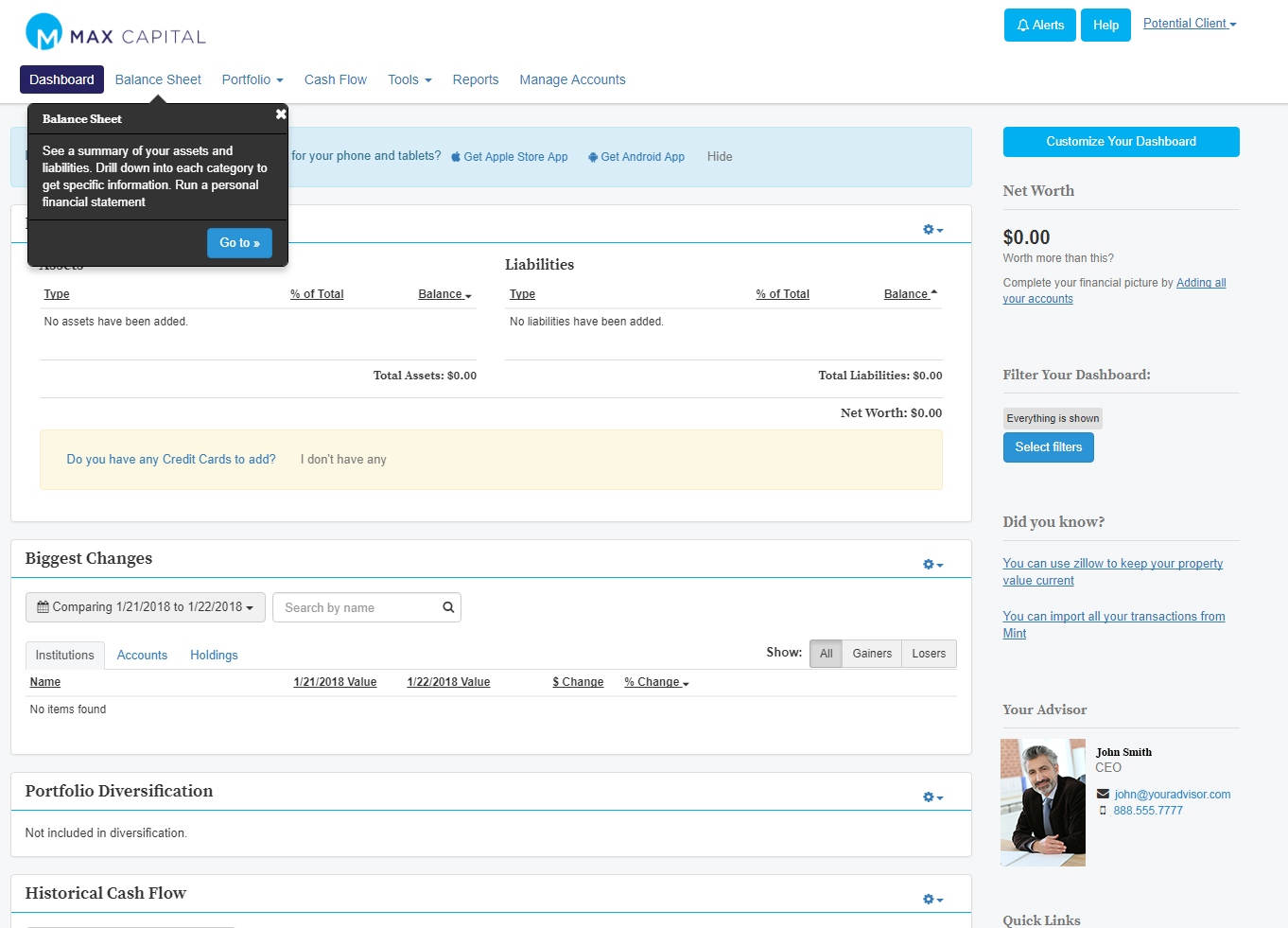

Once they sign-up, they will be helped through logging in and updating their balance sheet with a simple set-up wizard.

Wealth Access Helps Land a $10M Client

Savant Capital Management is an independent, fee-only wealth management firm with over twenty-five years of experience and $4.4 billion AUM. When looking into data aggregation solutions, the firm found that most platforms only offered one source of data. This meant that the firm had to initiate “one-offs” to get a client’s account into a system that wasn’t fed by its data feeds.

In other words, they realized they were wasting time and money on an inefficient system, and they came to us looking for a solution.

We eliminated their “one-off” problem, with our more than 20,000 institutional data feeds from multiple systems, and we integrated tightly into their proprietary client portal, which provided a Savant-branded experience to their clients. As you can see, we’re not just a data vendor focused on tech – we’re also a committed partner with expertise in the financial advisory space.

“One of the first accounts we set up was for a $10 million prospect who, while going through the process, was reticent to change advisors because his wirehouse advisor offered him an aggregation solution he used each day,” said Ellen Poppen, CIO of Savant. “Wealth Access allowed Savant to provide an alternative aggregation solution that allowed us to eliminate that final objection and close on the prospect.”

Want to hear more about Savant’s experience with Wealth Access? Download the Full Case Study Here

How to Setup Your App for Prospecting

Signing prospects up is as simple as putting in their name and email address, after which they can easily add their financial accounts directly from your web or mobile app. By giving people a reason to input their data (spending/saving analytics), you remove the hurdle of convincing them to hand over financial information.

After that, you can easily access this data on the advisor side, where you can use it during meetings or phone calls, or when you’re creating a proposal or financial plan.

The process starts by simply inputting the prospect’s data to send a welcome email in the advisor web app. You can send a form message or customize it however you like.

Once they sign-up, they will be helped through logging in and updating their balance sheet with a simple set-up wizard.

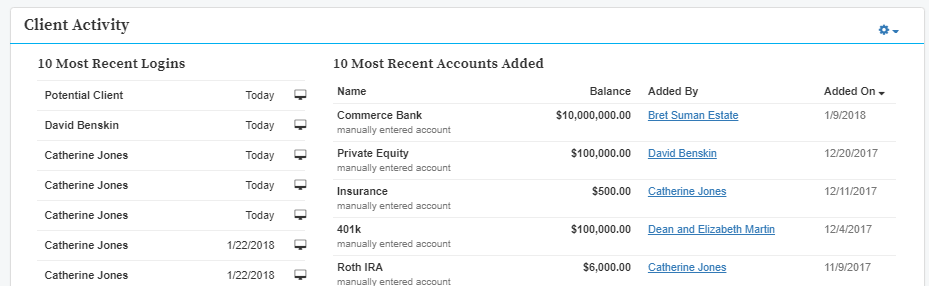

Once someone signs up for the app, you will receive an immediate notification to help drive your overall marketing strategy. You will also receive a weekly summary of client activity that provides valuable insights and drives more active conversations.

You can even access advanced analytics like asset locations, transactions, account types, devices used to log in, and held-away versus managed assets.

Here’s a sample dashboard showing recent client activity:

Finally, you can generate proposals or financial plans for prospects through integrations with third-party platforms like MoneyGuidePro, AdvisoryWorld, and HiddenLevers. By tying all of these pieces together, you can focus on building client relationships rather than spending all of your time trying to convince prospects to turn over or update financial data.

Getting Started

The prospecting experience in Wealth Access can give you the flexibility you need to create more meaningful conversations with clients. By providing them with a valuable tool, you become more knowledgeable about them over time and always have access to the information you need to craft tailored proposals and fine-tune financial plans.

Contact us today for a demo to see how we can help you grow your business using our new prospecting tool and other products.