In case you haven’t guessed, we’re talking about your existing clients’ children and grandchildren.

According to Matt Oechsli of the Oechsli Institute, less than one-quarter of financial advisors have expressed an interest in working with the children of their affluent clients, despite more than half of affluent clients believing that their children will have $1 million or more in investable assets. With the average client being a 58-year-old Baby Boomer, focusing on future generations could mean a bright future for your firm.

Today, I want to talk about how Wealth Access enables your HNW families to allocate fractional ownership of investments to various family members so everyone can keep up to date in the same place.

Keeping Everyone Updated

Financial advisors are on the precipice of a $30 trillion wealth transfer from Baby Boomers to Generation-X and Millennials. So why aren’t advisors establishing relationships with these descendants? The answer comes in many forms, but most either don’t have time to think about it or don’t see any benefit in it.

Want to see how our holistic account view can help firms grow? Click here to download our case study with New England Private Wealth Advisors.

But what if you could easily keep track of multi-generational relationships in a way that would benefit you today and thirty years down the line?

Our Estate Platform makes it easy to organize complex, generation-spanning portfolios with a management tier that enables account owners to split ownership of accounts between entities and family members. For financial advisors, this means deeper engagement with second and third generations, while also easily creating and tracking an unlimited number of entities and partnerships.

By visualizing data and permissions, future generations can see a portion of their wealth scale, which can help promote maturity and responsibility within ongoing family dynamics, meaning less potential intrafamily drama and more engagement. The platform also provides complete discretion when it comes to protecting the privacy of individual family members. Each family member can only see their own share – no one else’s – all but eliminating any potential friction.

Organizing Family Accounts

Our multi-generational views are especially great for managing complex estates, but they can do much more than divide up accounts. Non-HNW individuals can use the same technology to track various accounts and keep their family’s finances organized in a single location rather than spread out across various accounts and platforms.

These clients can easily track their children’s bank accounts or a 401(k) if those accounts need to be rolled up to the parents’ level. For example, a client with young children may set up an investment account in their name but still wish to track those assets alongside their own assets until the children turns eighteen. Housing all of this information in a single place makes it much easier to perform any analysis and access data when needed.

Future generations can also use their own dashboards to aggregate other valuable items, such as cars or collectibles, before they become a client. Since they’re regularly checking the platform for these needs, financial advisors can build a relationship with these potential future clients over time and be better positioned to have important conversations, while also getting a more holistic look into the financial assets of future generations.

It’s Easy to Get Started

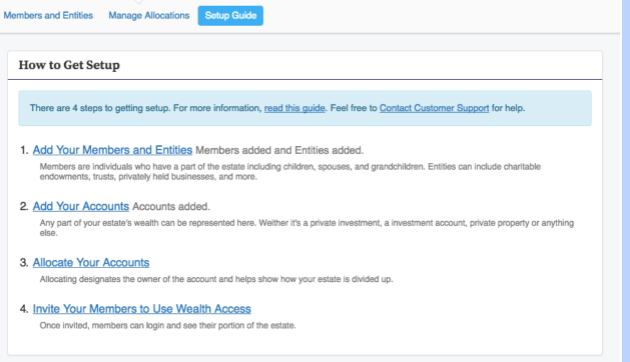

Our Setup Guide makes it easy to get started by adding family members and entities, adding new accounts, allocating accounts based on how the estate should be divided up, and then inviting members to login and see their portion of the estate.

The setup screen details these four easy steps, and there is a guide available to help explain any step in greater detail. In addition, our customer support representatives are always ready to answer any questions and help you overcome any hurdles.

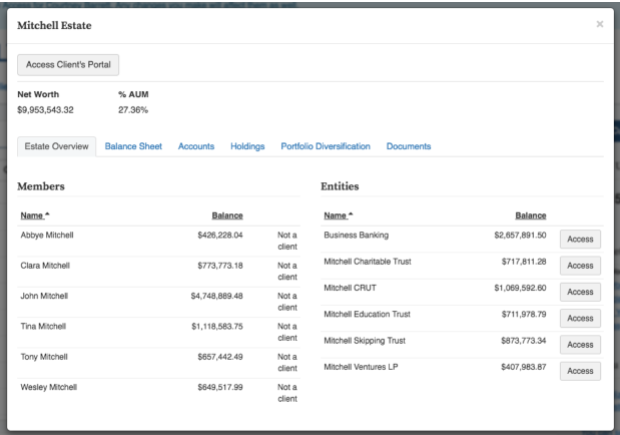

Once the estate is setup, you can login at any time to view the status of various members and entities, as well as make any adjustments. You can also access the client’s overall balance sheet, accounts, holdings, portfolio, documents, and other information from the same screen.

Improve Your Communication

Wealth Access is a revolutionary online platform that helps high net worth individuals and their advisors better understand and manage wealth.

In addition to the Estate Platform component, Wealth Access integrates data from tens of thousands of financial institutions and other sources to help investors and advisors gain a holistic view of their money and make smarter investment decisions for themselves and their families. We also provide custom-branded mobile apps and client portals to help clients and prospects succeed in the new wealth management era.

Want to see how our holistic account view can help firms grow? Click here to download our case study with New England Private Wealth Advisors.

If you would like to learn more about the Wealth Access platform and how it can benefit your firm and clients with multi-generational needs, contact us today for a free demo and consultation.