Wealth Access continues to make investments in the development and extension of your mobile/digital client experience and the advisor and firm tools that help drive insights and efficiencies in your organization.

This release will automatically take place on Thursday, August 13th. Please note that several of these enhancements are configurable and will not alter your current configuration until you decide to enable them.

Product Updates

Wealth Insights

Wealth Insights proactively identifies opportunities, trends, and risks across your client base by applying business intelligence techniques across clients’ account data, login activity, and profile information. The insights are delivered through intuitive and easy-to-use dashboards so your firm executives, administrators and advisors can respond and take action to deliver a higher level of client satisfaction and to move additional assets from held-away to managed.

With this release, Wealth Insights is now in Beta and we are looking for client organizations that might be interested in applying our business intelligence engine to proactively identify opportunities and risks across their set of clients.

Wealth Insights is available to client organizations that also subscribe to the Firm Insight module.

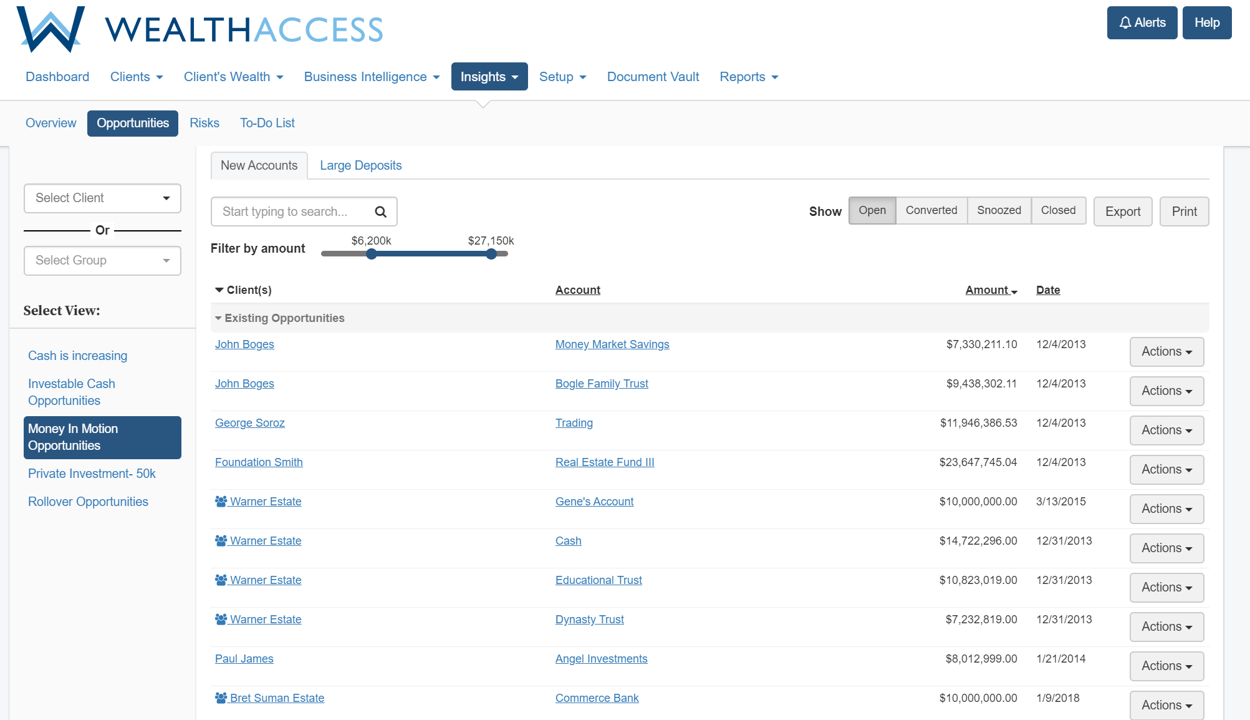

Advisor Opportunity Dashboard

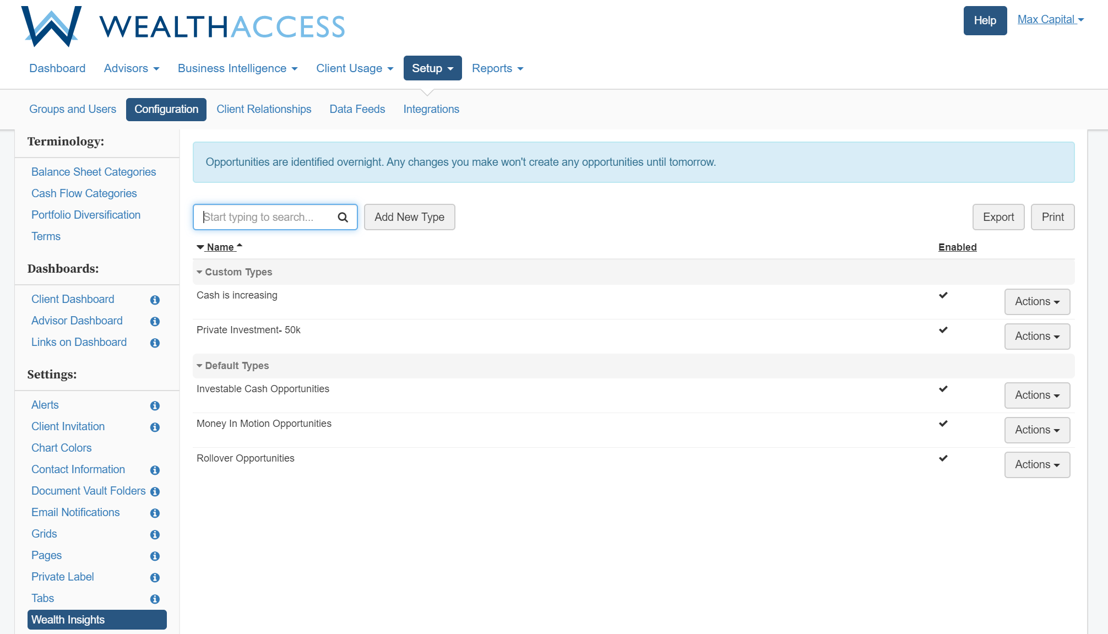

Configure Firm-level Opportunity Types

Client Updates

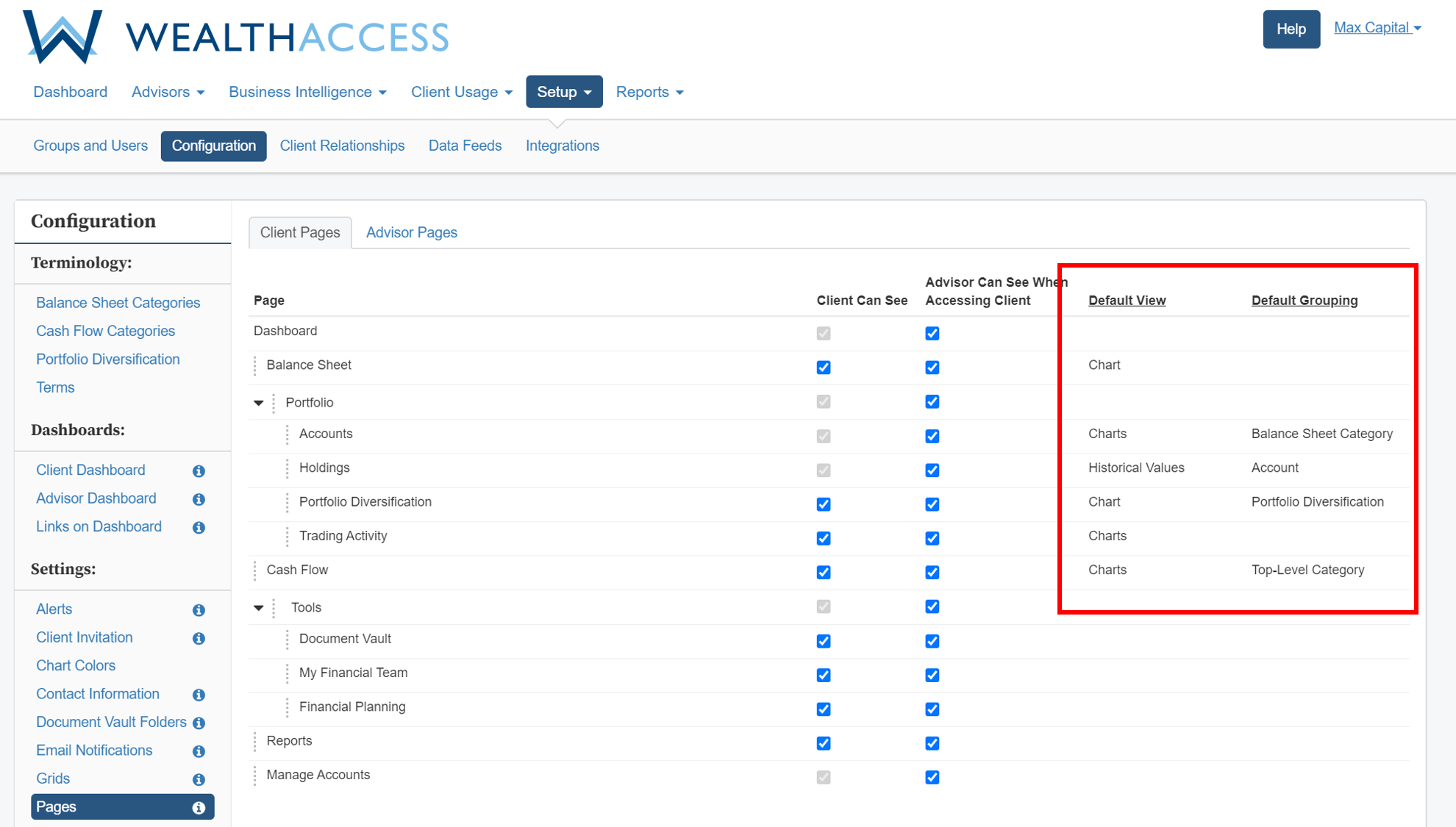

Default views and groupings

Firm administrators and advisors have numerous options to configure the client experience in Wealth Access, through default widgets, column ordering, and branding.

We are excited to also enable firm administrators the ability to establish default views and default grouping for certain pages in the client experience. Examples include the ability to default the holdings screen to group by portfolio diversification or defaulting the activity screen to the charts view.

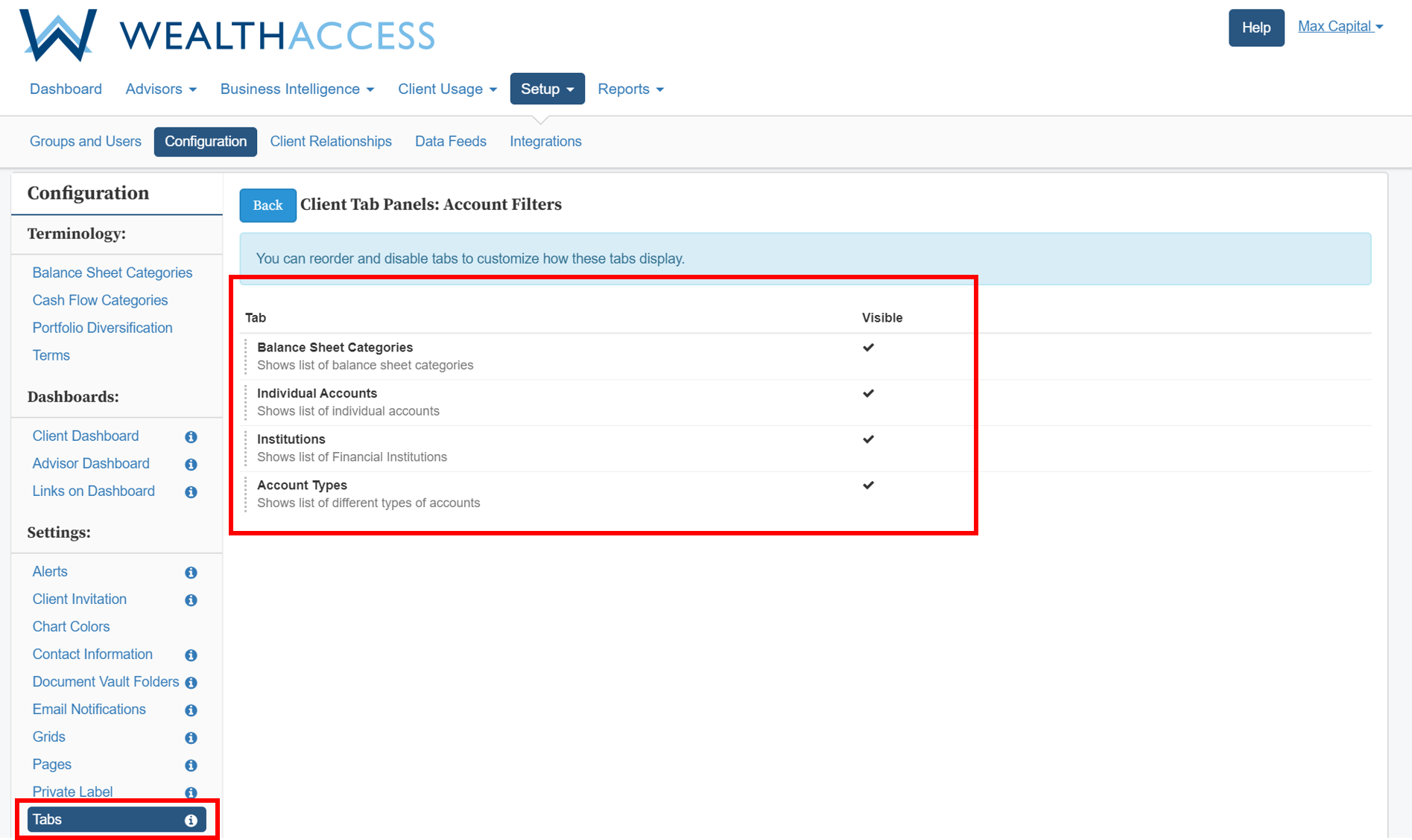

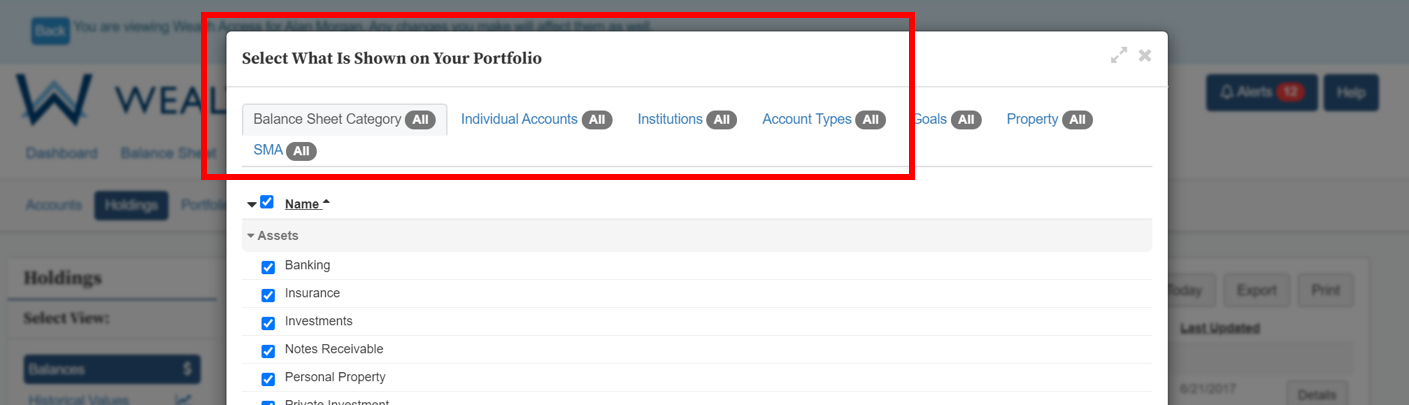

Configurable screen filtering options

Our client experience offers robust filtering capabilities across screens to allow clients to focus datasets on specific accounts, institutions, balance sheet categories, or account types.

Firm administrators can now take advantage of increased configuration options to determine which filters are visible and dictate the order in which the filters appear on the page.

Branding and White-labeling Enhancements

OWN YOUR CLIENT EXPERIENCE.

Login page

Firm administrators now have more configuration options for the login page to present an enhanced, customized experience for clients.

· The ‘Log In’ button color will now match the firm’s branding colors that have been defined in the system.

· The ‘About’ link can be configurable so firm administrators can establish an About page unique to the firm.

· The ‘Terms of Service’ link is now designed to match the same Terms of Service in the application.

Client Invitation

We now allow for additional white-labeling on the client email invitation for firm administrators to establish custom links at the bottom of the email. These links can be directed to firm-hosted pages for a more custom experience for your clients. The Wealth Access default links can also be turned off if desired.

Administration Updates

Setup page permissions

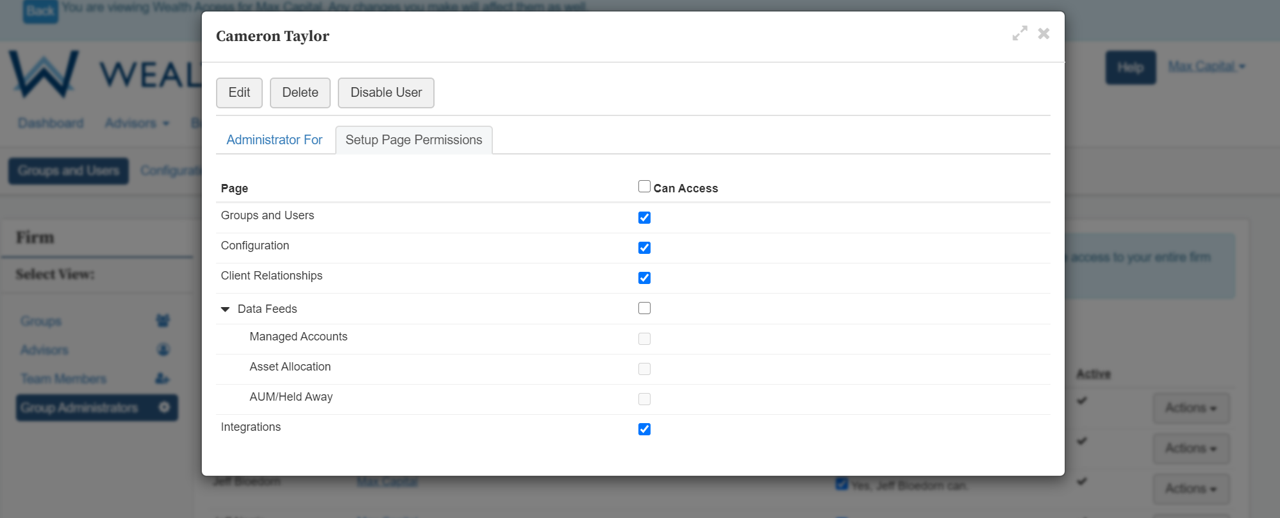

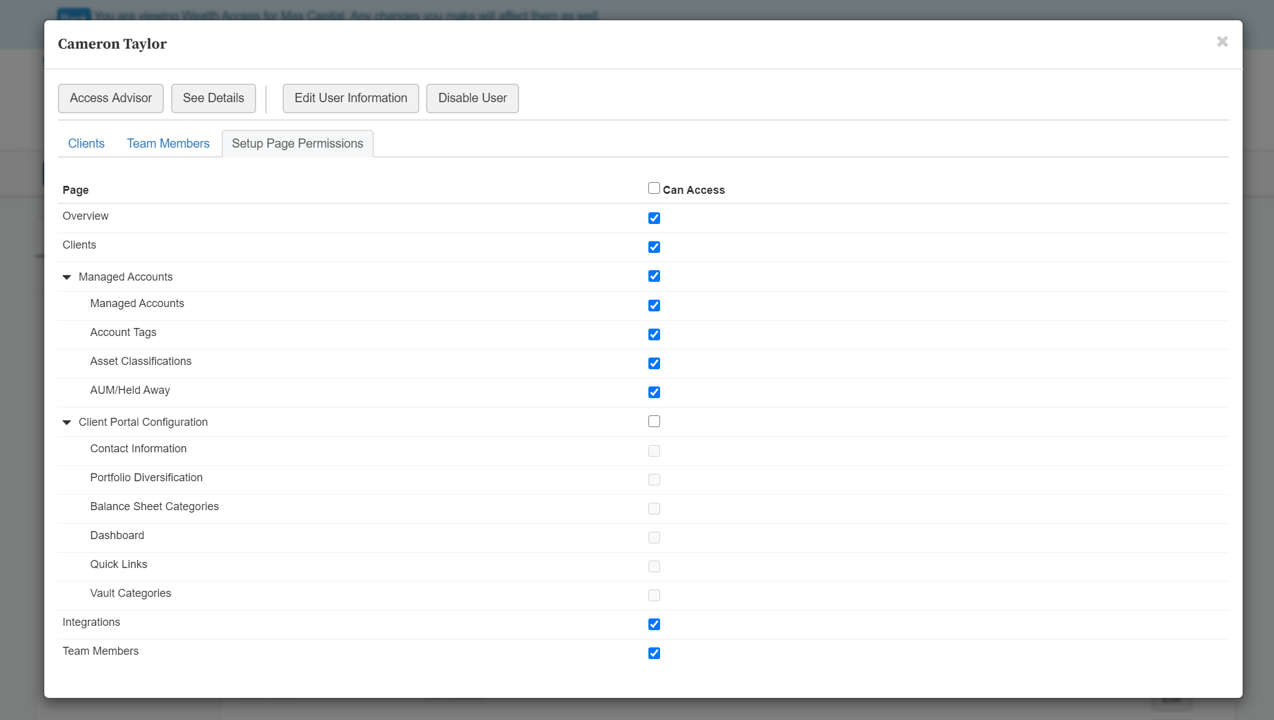

Wealth Access supports multiple roles in the system, including firm administrator, advisor, team member, prospect, and client. We understand that even though multiple employees may hold the same role, you may not want those employees to have the same level of permissioning and access for setup and configuration features.

We now allow you to determine what Setup pages each individual has access to for the Administrator, Advisor, and Team Member roles. At the Administrator level, these pages include Groups and Users, Configuration, and Data Feeds. At the Advisor or Team Member level, these pages include Managed Accounts and Client Portal Configuration.

Setup Page Permissions – Administrator

Setup Page Permissions – Advisor and Team Member

Data Infrastructure

Wealth Access Data Services

The Wealth Access platform runs on data and we are committed to continued investment in our data infrastructure to meet our clients’ growing needs.

Multi-faceted firms. We continue to ensure that we represent the entire financial picture that end clients have with your firm, by consolidating financial assets across trust, brokerage, wealth, retirement, banking, credit card, and insurance divisions at the household level.

Full balance sheet reporting. We are broadening the breath and depth of supported financial services institutions to ensure that your end clients have a single, financial dashboard, and also that your financial professionals have visibility into all of the clients’ financial assets.

Data aggregation. We are bringing more aggregation partners into our data aggregation as a service (DAAS) model to improve the accuracy and stability of held-away account data services.