Wealth Access continues to make investments in the development and extension of your mobile/digital client experience and the advisor and firm tools that help drive insights and efficiencies in your organization.

As part of the upcoming April Release on Thursday, April 16th, we are enhancing our user-directed Reset Password functionality with additional security measures.

Product Updates

Security Updates

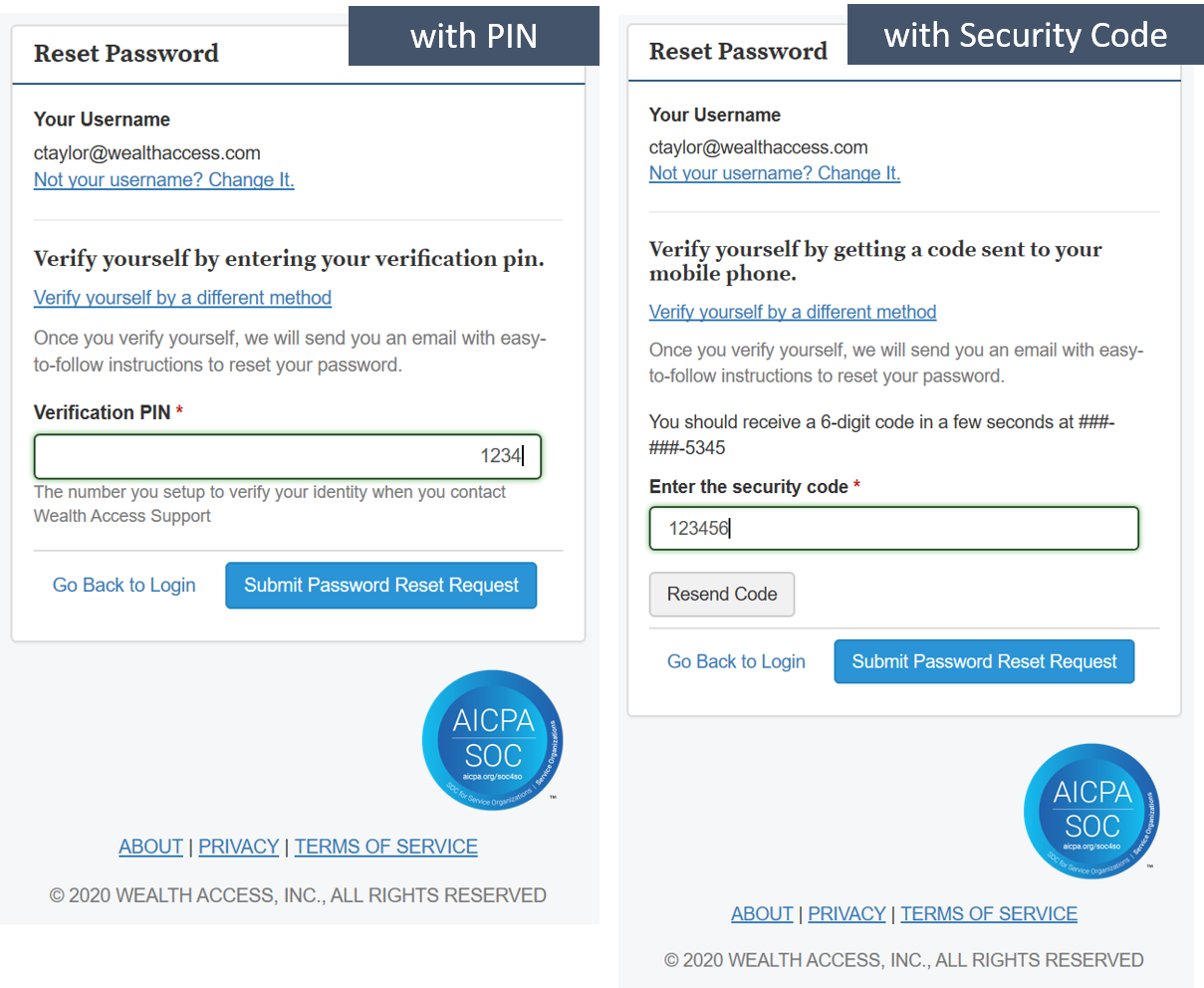

Reset Password

We are enhancing the Reset Password experience by adding additional secured options to allow users to verify a Reset Password request with a security code received through a mobile phone SMS text message or by entering their verification pin.

This enhancement will reduce the amount of locked out users and present a more efficient way of resetting a password in a manner that is common across other web applications.

For additional information, please see the communication that was distributed focused just on this security enhancement.

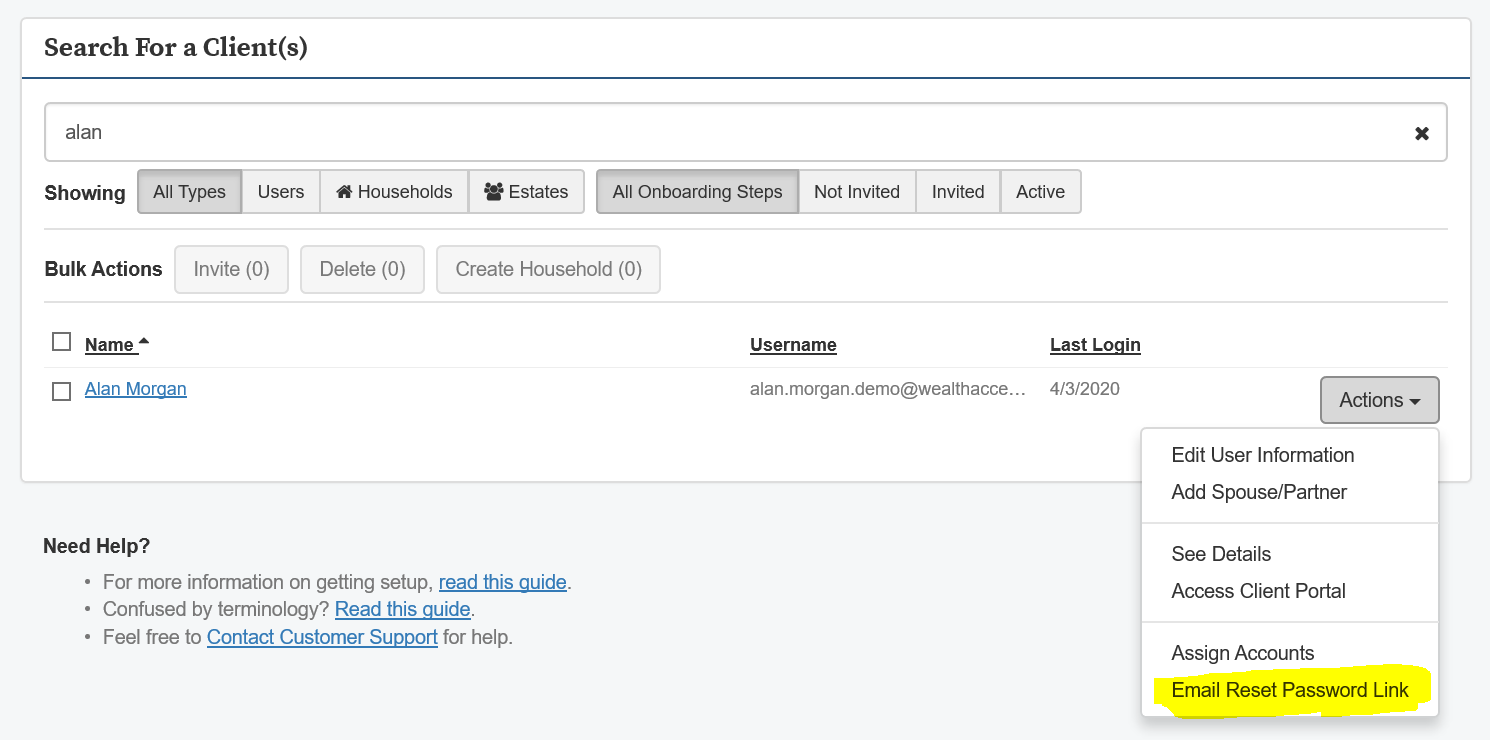

Email Reset Password Link

As part of our initiative to improve the Reset Password process for users, we are also including an option that allows firm employees with the proper entitlements the capability to email a reset password link directly to users. Previously, this capability required the involvement of the Wealth Access Client Success team.

To enable this capability, please contact the Wealth Access Client Success team.

Advisor Updates

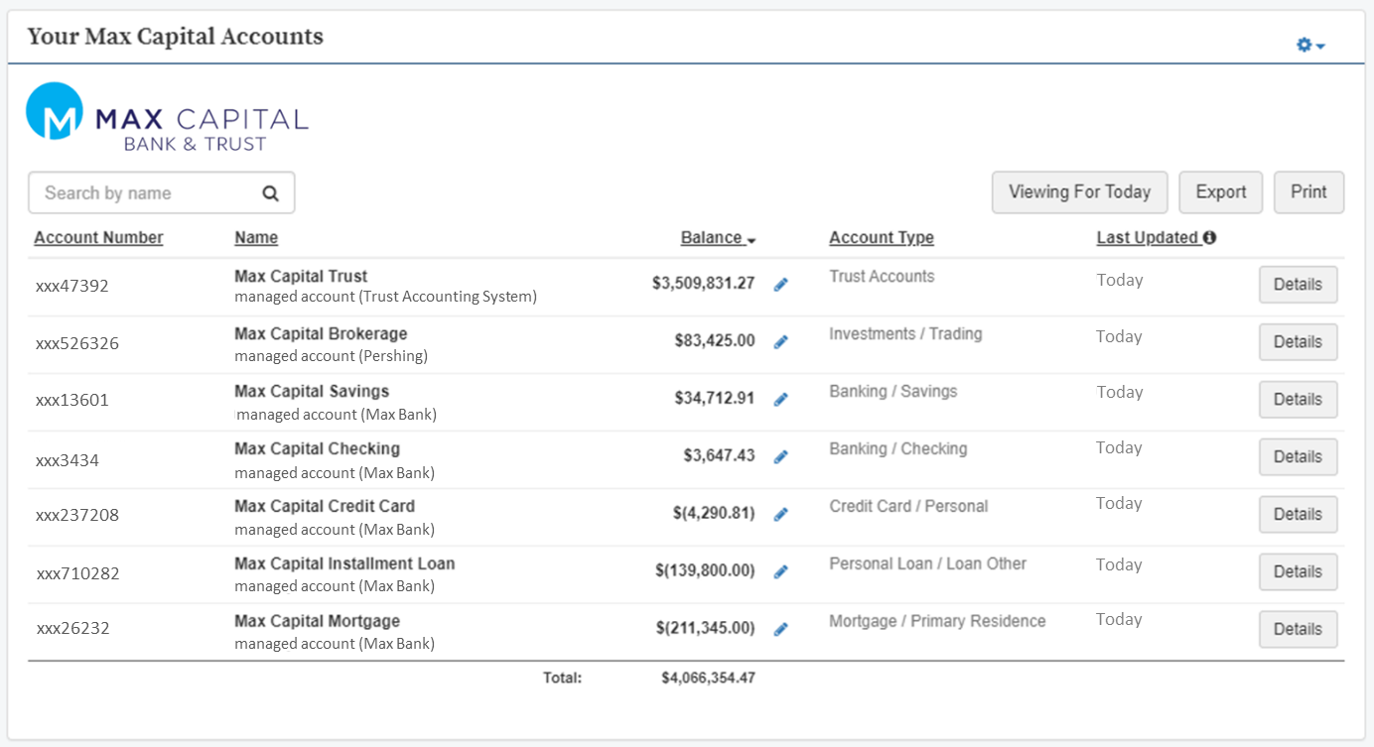

Managed Accounts Widget

We have added a new end client-level widget that will display only the accounts that are currently being managed by or through your financial institution. This may include trust, banking, brokerage, retirement, credit card, mortgage, or other accounts managed by the institution.

This addition will allow the wealth provider to show their managed accounts aggregated together in a single widget, and if desired, have this widget prominently displayed on the end client’s dashboard. Additionally, the wealth firm can optionally include its logo in the widget for branding purposes.

Included or excluded accounts and institutions are controlled by your firm through the available Data Feeds configuration tool.

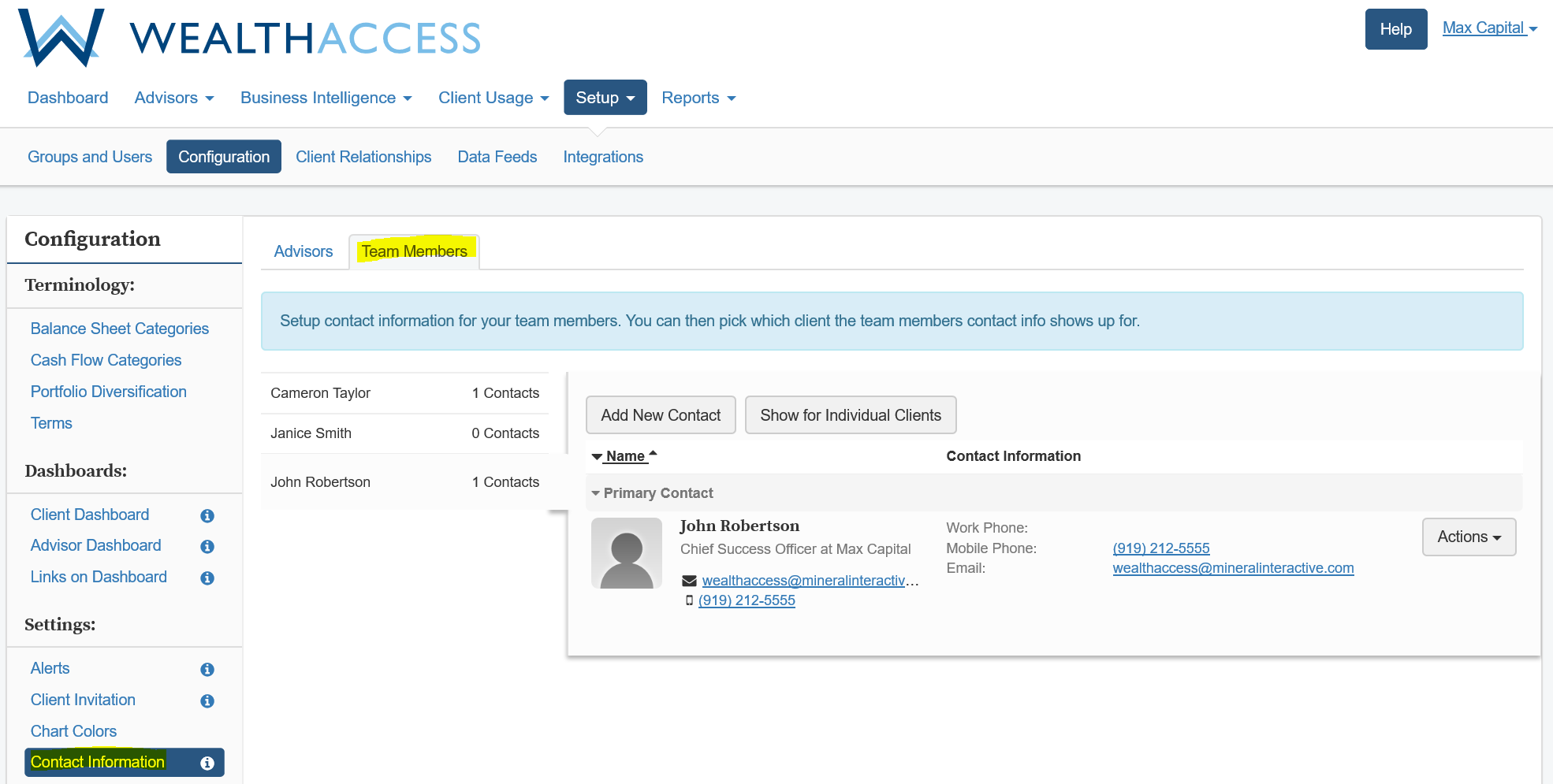

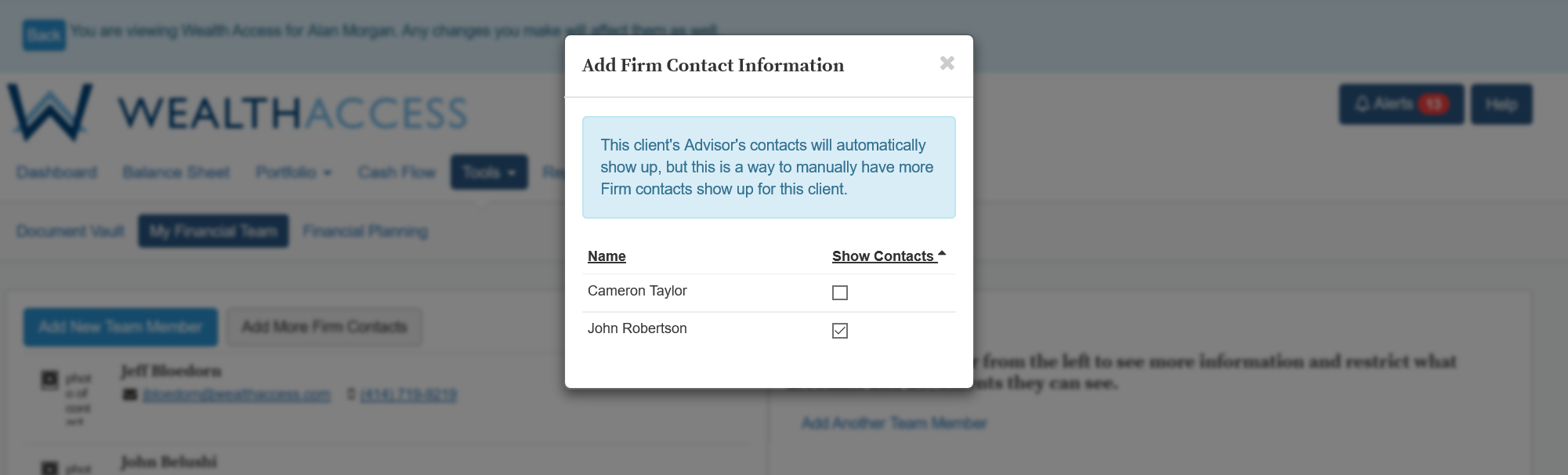

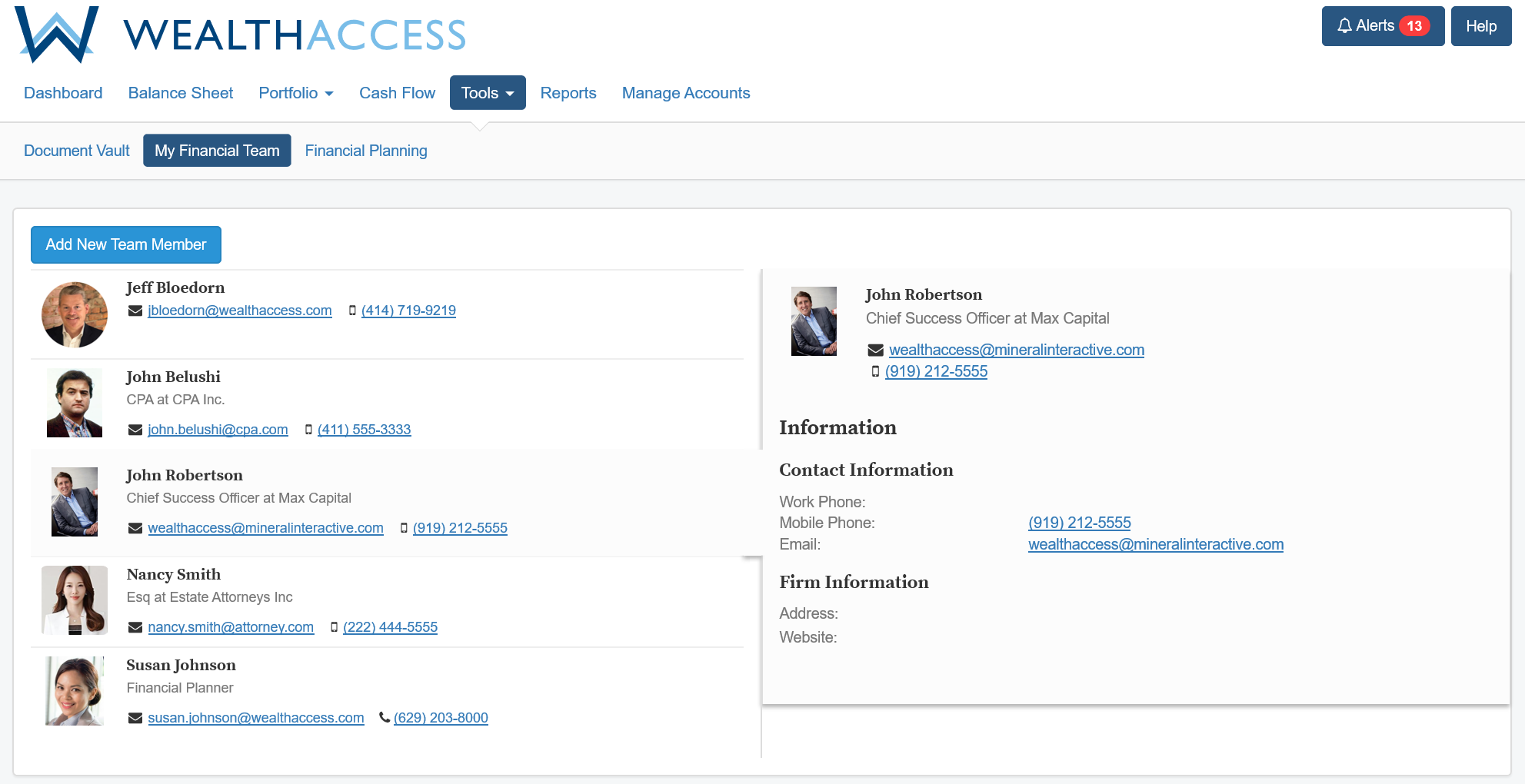

Client Financial Team – Add Team Members

The Client Financial Team feature of Wealth Access ensures that your clients have easy access to your team that supports their relationship. We have extended the capabilities for our Client Financial Team feature by allowing advisors to select and add existing Team Member users directly to the client’s financial team.

This enhancement includes the supporting functionality of storing contact information for team members. Once contact information is collected for a team member, the advisor can then add his/her team members directly to a client’s financial team. When the client next logs in to the client portal, the added contact will be part of his or her financial team.

Client Updates

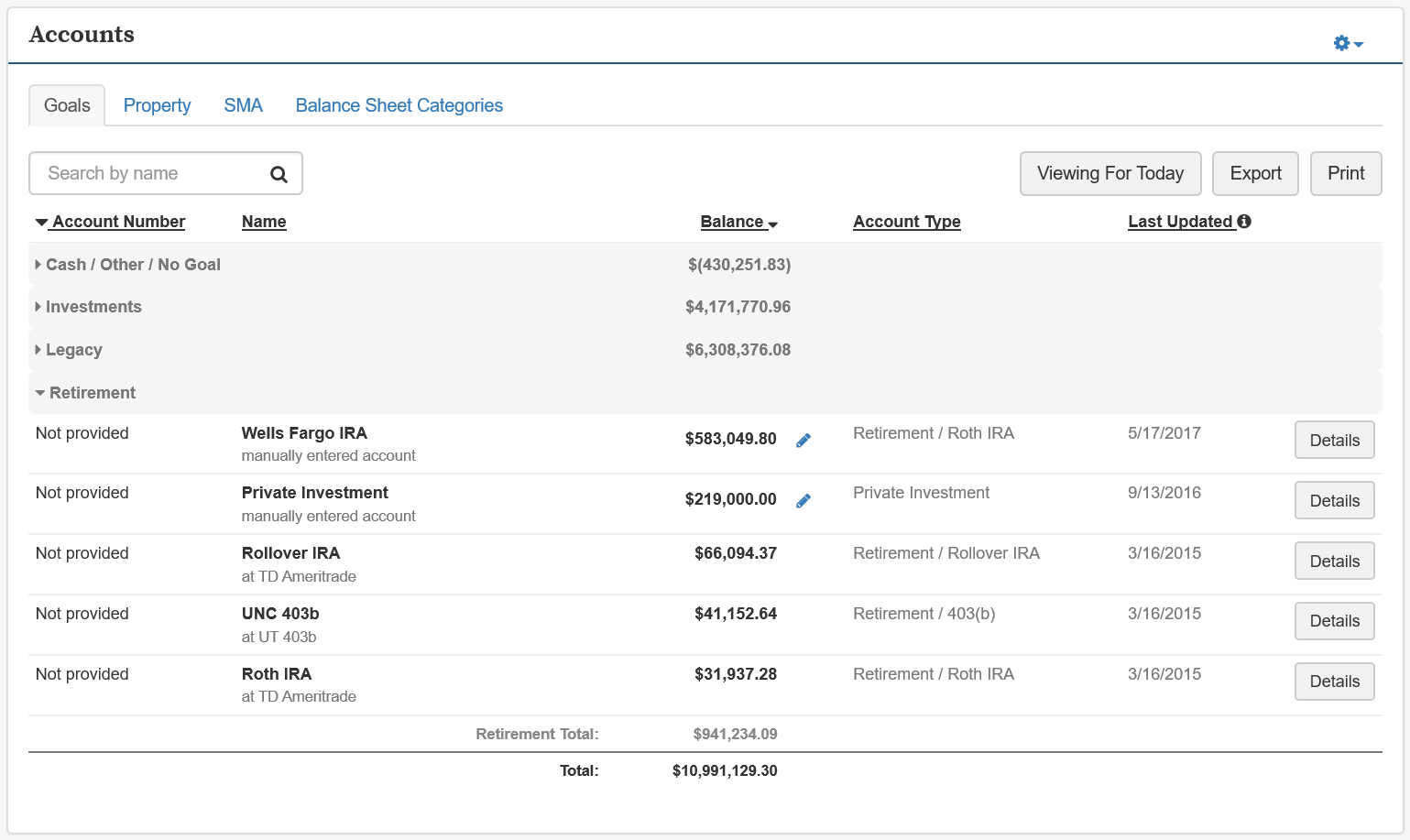

Account Listing by Groups Widget

Advisors and their end clients currently have the ability to establish groups for their accounts, in addition to the standard balance sheet categories. Common groups may be Investments, Goals, Property, or Cash. Users can then establish options in each group and tag accounts accordingly.

We are excited to add a new investor-level dashboard widget that showcases an account list in this manner.

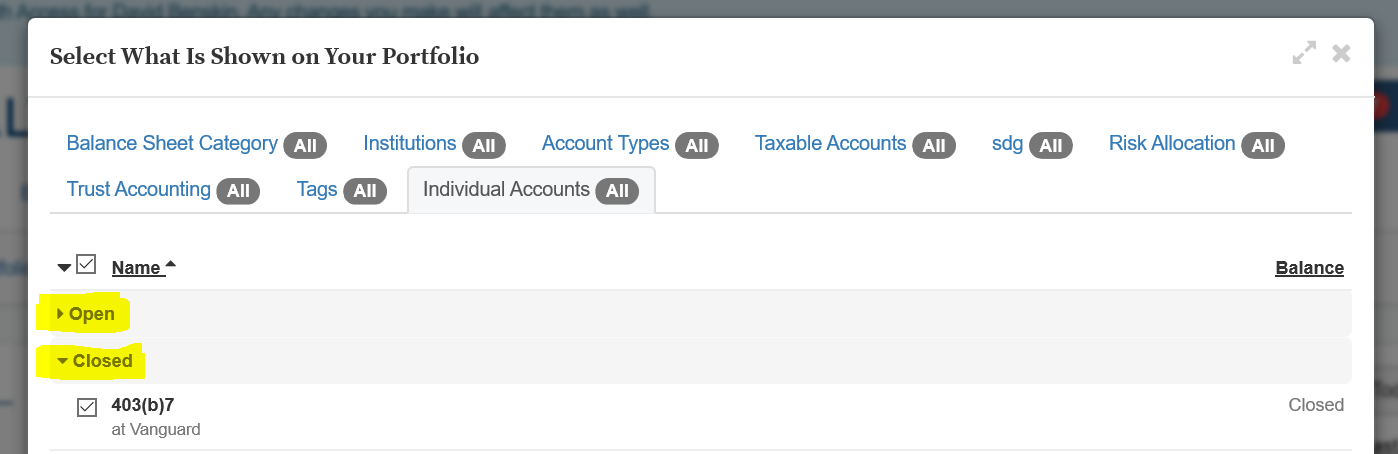

Account Filtering – Closed Account Option

The filtering capabilities in the user experience have been enhanced to allow users to see accounts grouped by Open vs Closed when filtering on individual accounts. This is particularly important when you are viewing historical data and would like to include or exclude closed accounts that may have affected those views.

When filtering accounts, the user can see the Open vs. Closed groupings under the Individual Accounts segment of the filtering screen.

New Partner Integrations

RightCapital Integration

We are excited to announce integration with RightCapital, a financial and tax planning technology provider serving independent advisors and advisor networks. This integration provides improved efficiency by allowing financial advisors and planners to pull client aggregated data directly into the RightCapital planning experience thus avoiding the need to recollect or rekey that information.

To learn more about the RightCapital integration and the opportunity to be an early adopter, please reach out to your RightCapital and Wealth Access account managers.

Coming Soon

Wealth Insights

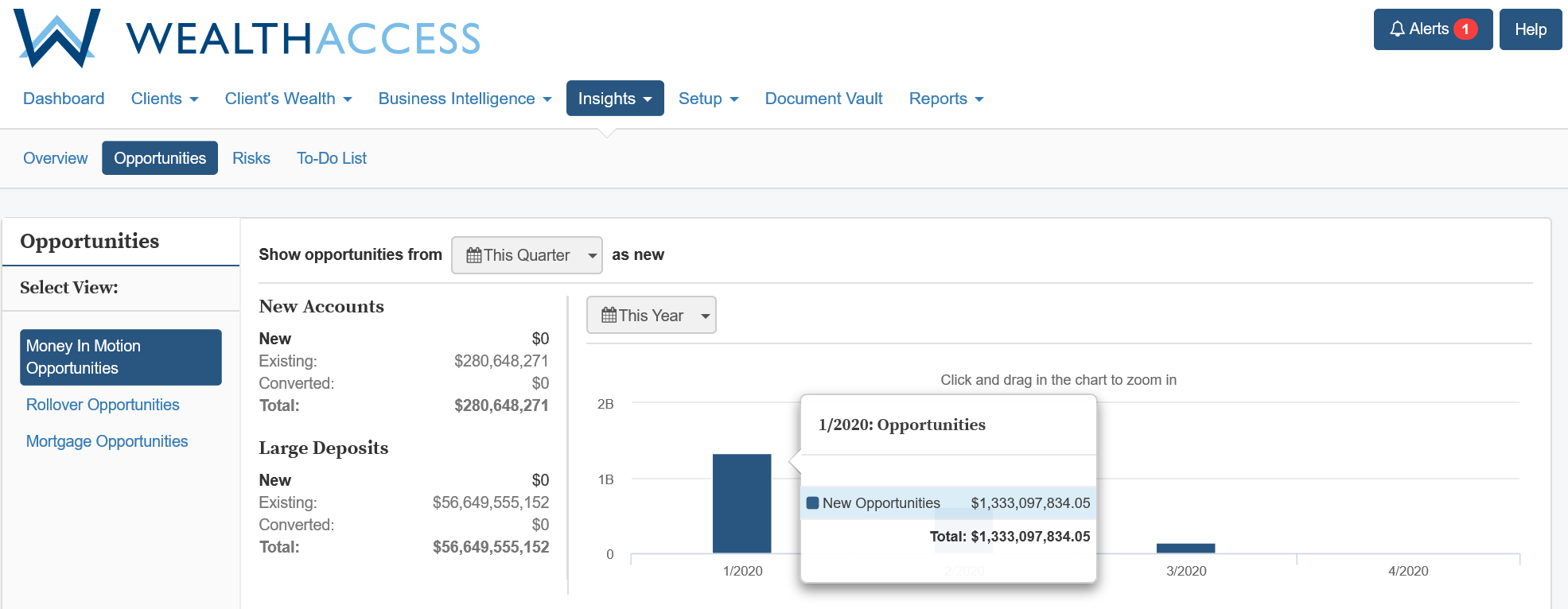

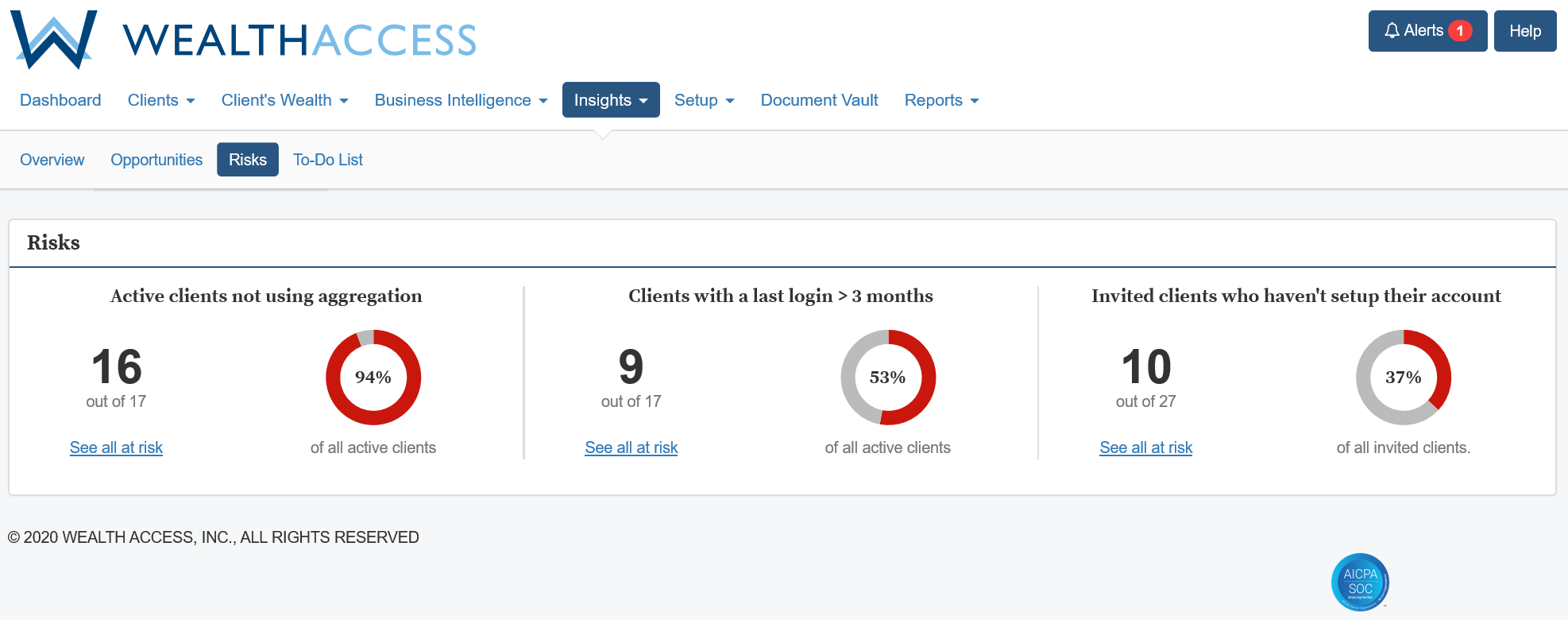

In February, we mentioned that throughout 2020 we will be enabling enhanced insights for firm executives, administrators and advisors to allow them to better understand risks, trends, and opportunities across their client bases. By applying business intelligence techniques across clients’ account data, login activity, and profile information, advisors will be able to proactively respond and take action to deliver a higher level of client satisfaction and to move additional assets from held-away to managed.

As part of this release, we continue to invest in Wealth Insights with a focus on the engine that systemically identifies opportunities for wealth professionals to proactively pursue. As opportunities are identified by our engine using firm-level rules, they are viewable by your employees through our new Insights tab in the Advisor portal.

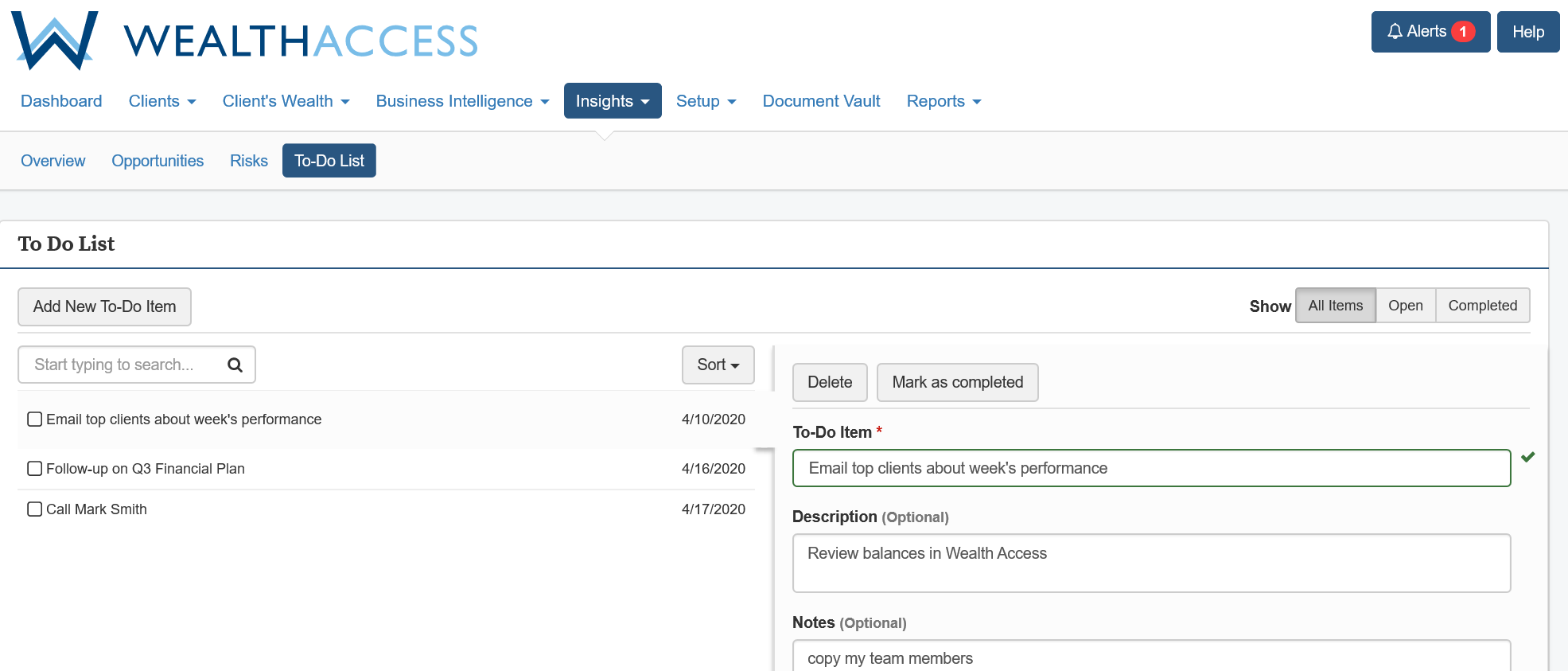

We have also added a new To Do List that wealth professionals can use to track in-progress opportunities or any other activities they need to track at the client level.

As we near the end of Q2, we will be looking for several client firms to explore Wealth Insights as early adopters.